Best Crypto Staking Platform in 2025

How to sign up to the best crypto staking platform

- Download the Best Wallet app to your iOS or Android device.

- Stake cryptos easily on the integrated staking aggregator.

- Earn higher APY staking rewards by holding BEST Tokens.

Why Best Wallet is the best crypto staking platform

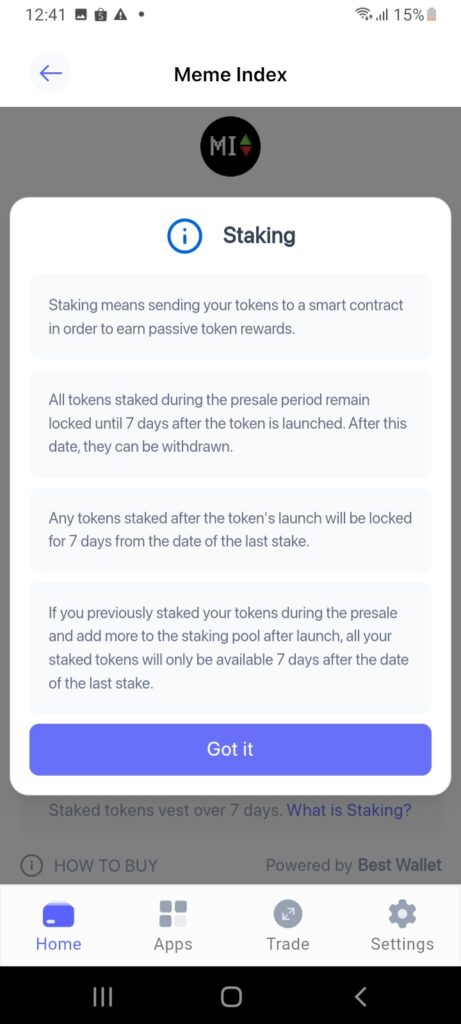

Best Wallet allows users to stake thousands of cryptocurrencies while maintaining control of their private keys. As a self-custody wallet, staking validators never touch client-owned tokens. Best Wallet leverages a staking aggregator within its mobile app, which scans hundreds of validators for the most competitive rates. Users can choose their preferred option based on the APY, lock-up terms, and fees.

With Bitcoin getting closer to its all-time high prices, it’s even more important to have one place where you can quickly cash in on your gains by converting them into stablecoins or redistributing them among altcoins with great potential. Best Wallet stands out exactly because it enables its users to have a non-custodial and no-KYC Bitcoin and altcoin wallet, as well as a staking hub, all in one place.

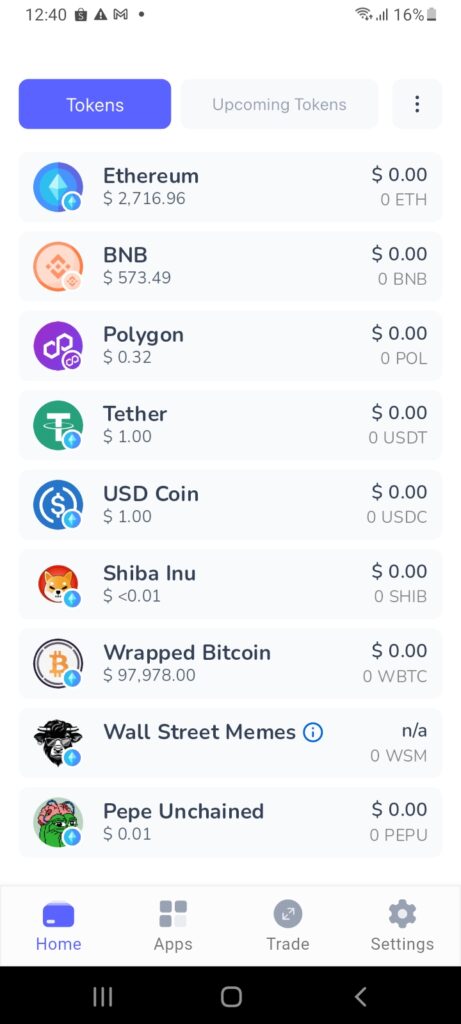

Stake crypto on over 60 different chains

Best Wallet is the best crypto staking platform for diversified portfolios. It’s compatible with over 60 popular networks, meaning users can stake multiple cryptocurrencies across different blockchain standards. For example, suppose you’re holding ETH, BNB, and MATIC. These cryptocurrencies operate on the Ethereum, BNB Chain, and Polygon networks, respectively.

Ordinarily, you’d need to set up multiple wallets, each connecting to a different staking validator. With Best Wallet, you can stake all of these networks without leaving the mobile app. This provides the perfect balance between convenience and self-custody ownership.

Other popular staking networks are supported too, ranging from Solana and Cosmos to Avalanche and Polkadot. Do note that secondary tokens can be staked too, such as USDT and USDC on the Ethereum blockchain. Crucially, Best Wallet uses a staking aggregator, meaning the highest rates are sourced in real time.

Staking aggregator

Understanding the aggregation system is important when selecting the best crypto staking site. Think of it like a comparison website but for staking rewards instead of loans or credit cards. First, users choose which crypto asset they want to stake. Suppose you opt for USDT, which offers staking APYs without volatility, considering it’s pegged to the US dollar.

Best Wallet’s aggregator then scans hundreds of validators. These are individuals or entities that connect directly to the blockchain, keeping it secure and decentralized. Best Wallet users are then shown a list of USDT validators alongside their staking APY. Clicking a validator reveals additional information, such as the lock-up terms and fees.

You can then choose a validator accordingly. For example, one validator might offer the highest APY of 14% on USDT. This could be based on a three-month lock-up period with 3% fees. Conversely, another validator might offer APYs of 9% but with a minimum lock-up of one week and fees of 2%.

Therefore, users should assess their priority, whether that’s staking terms or rewards. After selecting a validator and confirming, the cryptocurrencies are sent from the Best Wallet balance via a smart contract. This ensures rewards are earned without giving away control of the private keys, a crucial aspect when selecting a crypto staking program.

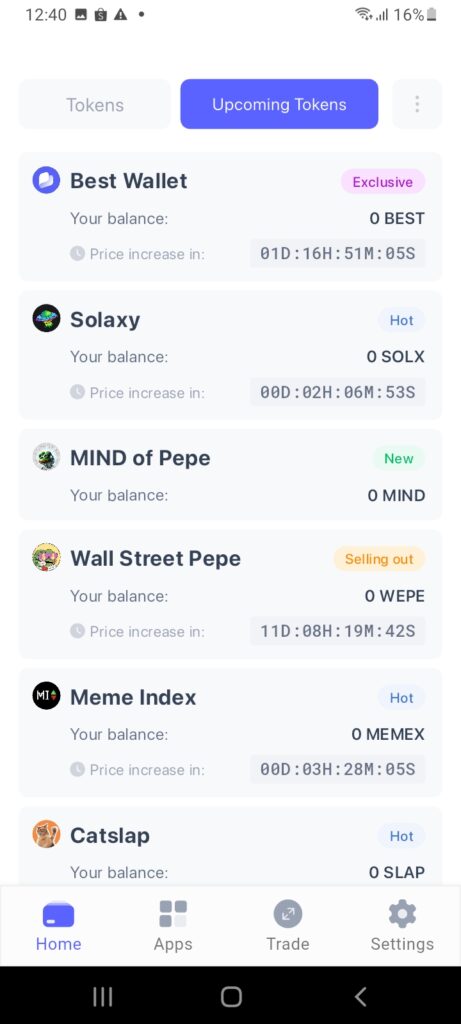

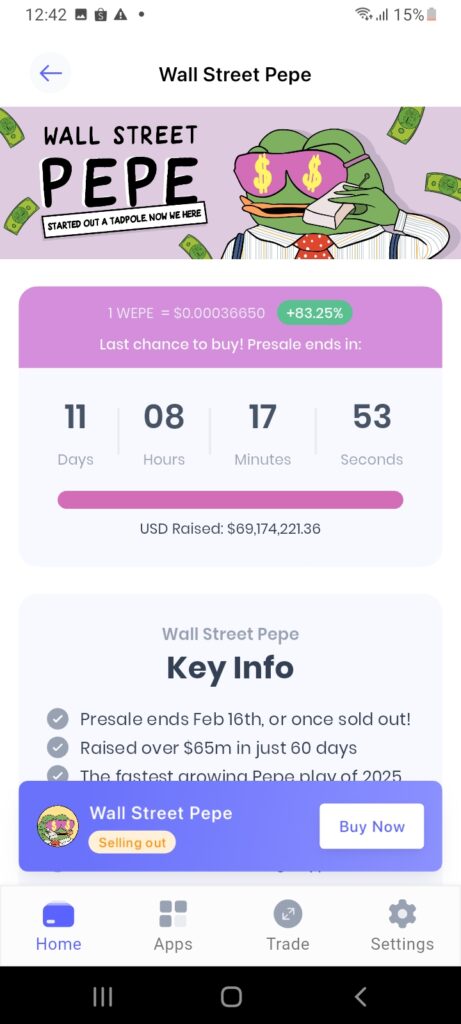

Get the highest crypto staking APY on upcoming tokens

Another feature available to Best Wallet users is the upcoming tokens launchpad. This is where new and innovative blockchain startups raise capital, allowing traders to buy tokens before they’re listed on exchanges. The key benefit for launchpad traders is a discounted token price and the ability to buy at a small market capitalization.

Now, many launchpad projects operate on staking blockchains like Ethereum and Solana. Moreover, launchpad traders can often stake their tokens immediately. This means the number of purchased tokens is amplified, translating to a higher balance once they’re added to public exchanges.

Let’s look at some examples of the staking rewards available when participating in Best Wallet launchpad events.

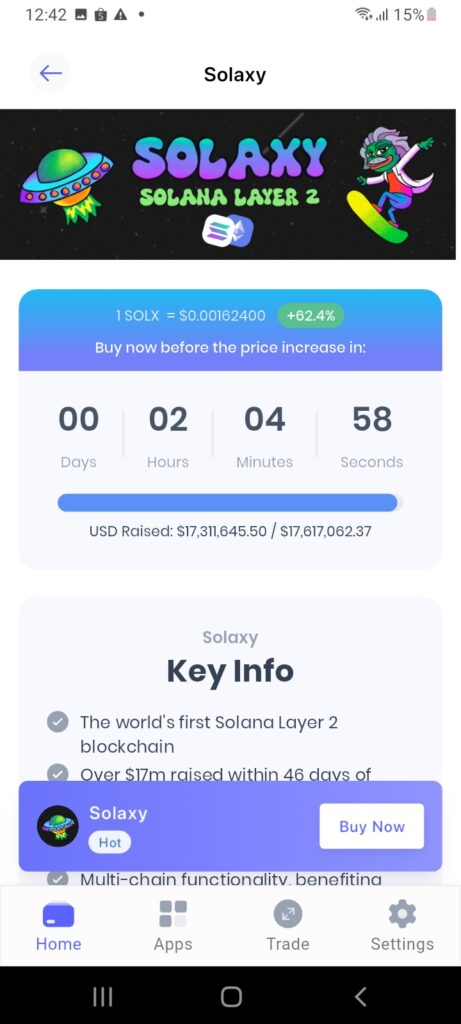

- Solaxy (SOLX): This launchpad project is offering huge staking APYs of 119% right now, providing a massive boost for early buyers. Solaxy is building a layer-2 network for Solana Program Library (SPL) tokens, which now covers millions of meme coins. Its network not only improves reliability but also offers higher scalability, faster verification times, and lower fees.

- BTC Bull Token (BTCBULL): One of the larger presales in recent months, BTC Bull Token is enhancing its holders’ BTC exposure by offering free BTC and BTCBULL airdrops, as well as BTCBULL token burns whenever the largest cryptocurrency breaks a new $25K price increment. BTCBULL tokens are currently offering staking APYs of 75%.

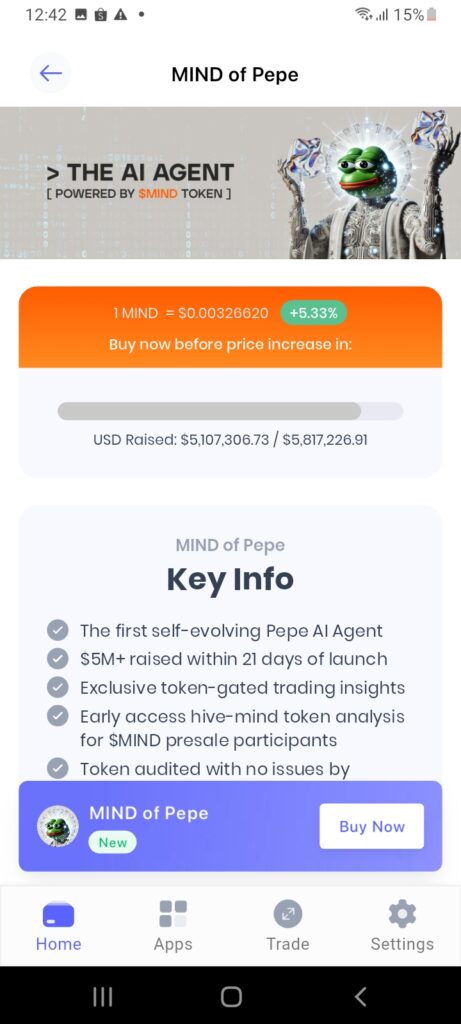

- MIND of Pepe (MIND): Another trending project from the Best Wallet launchpad is MIND of Pepe. This is an artificial intelligence (AI) crypto agent that operates autonomously. This means MIND holders are served by advanced intelligence insights rather than human input. MIND of Pepe, having raised several million dollars already, is currently offering substantial staking APYs of 255%.

Staking launchpad tokens on Best Wallet couldn’t be easier.

- Most launchpad events accept ETH and USDT without any minimum deposit requirements.

- You can instantly buy ETH or USDT anonymously, with Best Wallet supporting e-wallets, credit cards, and more.

- The ETH or USDT is transferred to the launchpad project, and the newly purchased tokens immediately start earning staking rewards.

- After the launchpad event finishes, the tokens will be listed on crypto exchanges, allowing the general public to trade them.

Stake $BEST Token for even better rewards

BEST is Best Wallet’s ecosystem token. In addition to lower fees, priority access to upcoming launchpad events, and governance rights, BEST also enhances the staking experience. This is because BEST holders get increased staking rewards, allowing users to maximize passive income.

In addition, $BEST tokens also generate staking payouts, considering they operate on the Ethereum blockchain. This means users will earn even more rewards, alongside the other holder perks mentioned. Currently, $BEST tokens are being sold via the Best Wallet launchpad, with more than $9 million already raised.

The launchpad event offers a discounted price to early buyers, with the rate increasing every few days. During the launchpad fundraising process, users can select the “Buy and Stake” option. This means $BEST tokens begin earning passive rewards from the get-go. The staking APY is dynamic, currently at 188%.

The most secure crypto staking platform

The best crypto staking platform should offer robust security features. While Best Wallet is a self-custody wallet, a wide range of safety controls have been developed. This ensures that users can store, trade, and stake tokens in complete safety.

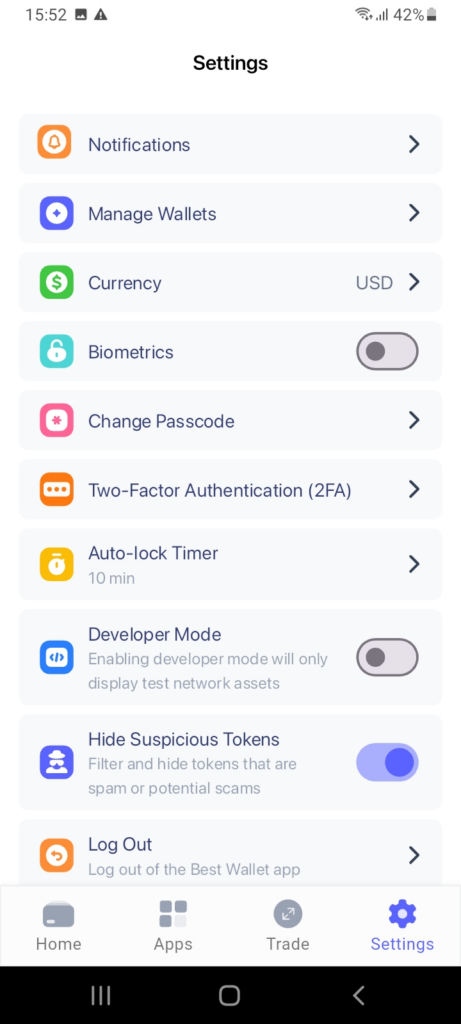

Some of the security features available to Best Wallet users include:

- Custom PIN

- Biometrics

- Two-factor authentication

- Anonymity (meaning no KYC document data breaches)

- Suspicious token warning

Users should have a solid understanding of security best practices before getting started with the Best Wallet app.

First, users are always asked for a PIN when opening the app, which must be a minimum of 4 digits. It’s also possible to replace the PIN requirement with biometrics. This means the app is accessed with a fingerprint ID, which is considered the more secure option.

Best Wallet users can also activate two-factor authentication. This requires a unique code whenever the app is accessed. The code is sent via SMS to the user’s stated number. Using a separate device is the smartest option here.

For instance:

- Mobile device 1: Used to access and manage the Best Wallet app, including staking, trading, and storing tokens

- Mobile device 2: Used to receive the SMS code when logging into the Best Wallet app

As per the above example, unauthorized access wouldn’t be possible unless the perpetrator had access to both devices.

In addition, Best Wallet offers an automated warning system when suspicious tokens are deposited into the wallet balance. This is switched on by default. For those unaware, scammers will randomly transfer crypto tokens to active wallet addresses.

This is almost always a phishing attempt, where users are asked to visit the project;s website to “claim” their tokens. This involves connecting a wallet, which will subsequently be drained.

Fully anonymous crypto staking

Many buyers seek an anonymous experience when selecting the best crypto staking platform. This can only be achieved when using a self-custody provider like Best Wallet. Downloading the app requires no account sign-up, meaning users aren’t asked to enter personal information.

As mentioned, users can enter a mobile number to activate two-factor authentication but this isn’t mandatory (but recommended for enhanced security). Nonetheless, Best Wallet comes without know-your-customer (KYC) requirements, regardless of which ecosystem features are being used.

This means users can stake cryptocurrencies without revealing their identity. What’s more, while staking rewards are taxed as income in most countries, Best Wallet is unable to report transactions to government agencies. This is because it doesn’t collect or store user data, as transactions aren’t tied to the user’s name.

It’s important to remember that many crypto staking platforms are centralized, including online exchanges. This means that KYC documents such as a passport and proof of address are mandatory. The risk here is a potential data breach, with centralized platforms having a single point of failure. Best Wallet’s privacy-focused no KYC exchange ensures users avoid this risk.

Anonymity is also retained when swapping and buying tokens, even when using fiat currencies. The latter covers everything from credit cards and Google Pay to Skrill and local bank transfers. However, fiat purchases and sales without KYC do come with limits, depending on which gateway is processing the transaction.

The highest-rated crypto staking app

When choosing the best platform for crypto staking, users should spend ample time assessing reviews from existing customers. Best Wallet is currently an app-only provider, meaning reviews can be analyzed from Google Play and the App Store.

Best Wallet boasts excellent ratings across both app stores, with many 5-star reviews from users around the world. Some of the most common feedback received concerns Best Wallet’s quick, simple, and private set-up process.

Best Wallet reviews also mention how user-friendly the app is, with staking, trading, and transferring tokens easy to navigate.

Other useful features

Best Wallet isn’t just the best staking platform – the app comes packed with other useful features. The Best Wallet ecosystem offers everything crypto traders need to maximize gains while retaining privacy. All in a secure and beginner-friendly environment.

Learn more about Best Wallet’s most popular features:

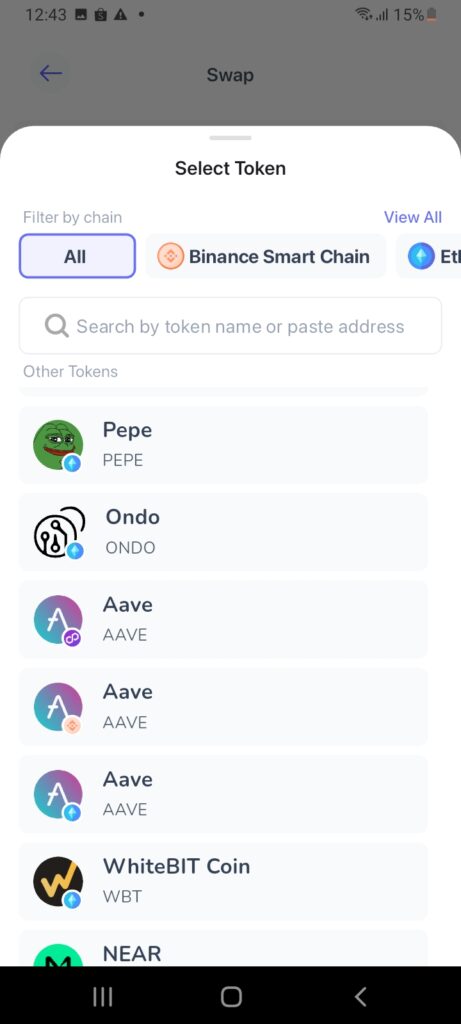

Swap tokens instantly across different chains

Best Wallet offers an anonymous decentralized exchange that supports the most popular networks. Users can instantly swap tokens stored within the Best Wallet app, with trades executed by liquidity providers. This means swaps remain on-chain, with no input from centralized parties.

Crucially, users always retain full control of their crypto assets, removing counterparty risks. For example, suppose you’re currently holding DAI. However, you’ve noticed that USDC can be staked at 13%, which you wish to take advantage of. Within seconds, you can swap DAI for USDC at market-leading rates.

This is because Best Wallet’s aggregation tool searches for the highest APY crypto staking platform. In this example, that’s DAI/USDC. Once the swap is complete, the user can proceed to stake USDC without leaving the Best Wallet interface. Users also benefit from Best Wallet’s cross-chain functionality, with blockchain interoperability covering 60+ network standards.

For example, you now want to swap USDC for SOL, which operates on the Ethereum and Solana blockchains respectively. With Best Wallet, these tokens can also be swapped immediately even though different token standards are used. This makes the cross-chain swapping process seamless and fast, without centralized intermediaries ever being used.

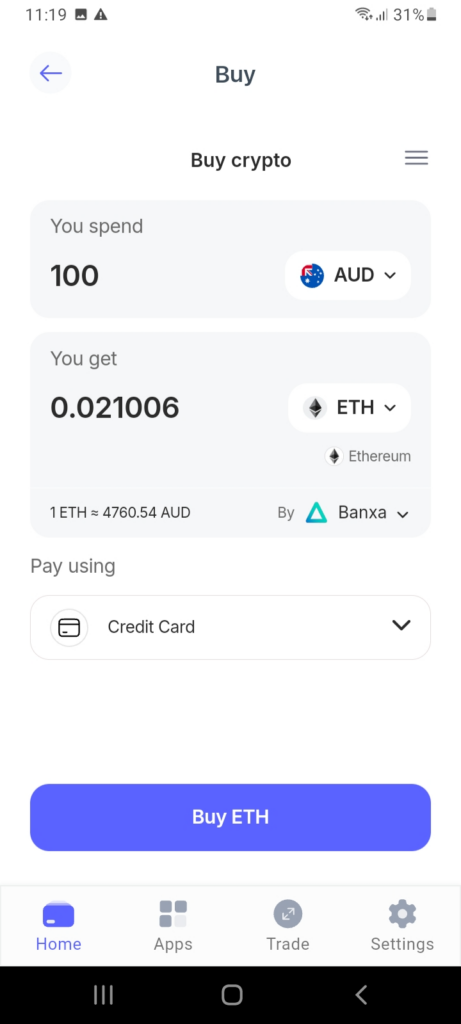

Buy and sell cryptocurrencies with fiat money

Best Wallet is also the best crypto staking platform for buying and selling tokens with fiat money. Partnered gateways support on- and off-ramp services, ensuring users can buy and cash out with local currencies.

For example, you might want to buy BNB with a debit/credit card to benefit from high APY crypto staking. Dozens of currencies are supported, from EUR and NZD to GBP, USD, and AUD.

The most popular payment methods are often accepted, such as Google/Apple Pay, Visa, MasterCard, Skrill, Neteller, and bank transfers. No KYC procedures are in place (variable limits apply), meaning users remain anonymous even when fiat currencies are involved.

Engage with decentralized applications (dApps) via WalletConnect

Best Wallet is compatible with WalletConnect, which bridges the gap between self-custody wallets and decentralized applications (dApps). This means wallet balances can be used to access a wide scope of innovative dApps, including decentralized exchanges like PancakeSwap, SushiSwap, and Raydium.

Not to mention NFT marketplaces, play-to-earn games, iGaming sites, and lending protocols. WalletConnect is also supported on desktop websites, enhancing the Web 3.0 experience for Best Wallet users. For example, suppose you want to browse virtual real estate in the Decenetraland metaverse.

First, you visit the Decentraland website. Then, you click the “WalletConnect” option and scan the QR code with the Best Wallet app. After confirming the connection via Best Wallet, you can use Decentraland on a desktop device. Importantly, any transactions (such as buying land plots) must be confirmed within Best Wallet, ensuring high robust security at all times.

How to get started with the best crypto staking platform

Follow these simple steps to get started with the best DeFi staking platform:

Step 1: Download the best wallet app

Download and install the Best Wallet app. Visit the Google Play or App Store and you can get Best Wallet in just a few clicks.

Consider using a VPN for enhanced security and privacy, meaning the app download isn’t linked to your IP address.

Step 2: Complete the security steps

Open the Best Wallet app to create a new wallet. You will now be taken through several security steps to ensure long-term safety. This includes choosing a PIN, required whenever the Best Wallet app is opened.

Change this to biometrics later, meaning you’ll access the app with a fingerprint ID. The next part is very important – you will be shown your backup passphrase. This is needed if you can’t access Best Wallet, perhaps because the device is lost or damaged.

The backup passphrase, consisting of 12 randomly regenerated words, must be written down in the correct order. Do this on a sheet of paper rather than a mobile or laptop device. Sharing the backup passphrase with another person will provide them access to the wallet remotely.

Therefore, just like an online bank account password or a credit card PIN, never share this with anyone. Finally, we strongly suggest activating two-factor authentication (2FA) for added security. You’ll need to enter the mobile number that the SMS code should be sent to.

Step 3: Add crypto to the best wallet balance

You can’t stake cryptocurrencies without first adding some tokens to the Best Wallet balance. This step works like any other self-custody wallet – you simply need to transfer tokens to the provided wallet address.

For example, suppose you want to deposit BNB. Just click the “BNB” button within the app followed by “Receive”. The wallet address is displayed as a QR code and in its long form.

Looking to deposit tokens that aren’t initially shown in Best Wallet?

You can add custom tokens by clicking “Manage Tokens” followed by “Import”. Select the network (e.g. Ethereum) and paste the token’s unique contract address. After confirming, the token will be added to the wallet interface, meaning you can make a deposit.

Step 4: Buy staking cryptocurrencies with fiat money

Best Wallet is the top crypto staking platform for buying tokens anonymously with everyday payment methods. This is the best option if you want to earn staking rewards but don’t currently have any tokens.

So, click “Trade” and “Buy”, then choose the preferred currency, such as GBP or NZD. Type in the purchase amount and choose which staking token to buy. Then select the preferred deposit type, such as a credit card.

Best Wallet then matches you with the payment gateway offering the most competitive exchange rate, as per your parameters. Proceed by entering the payment details and confirming the purchase. You’ll see the staking tokens in the Best Wallet balance within minutes.

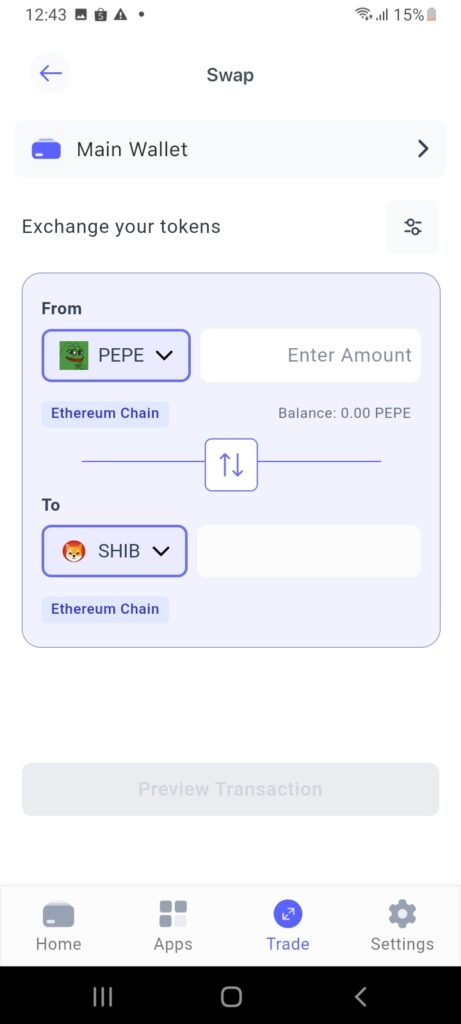

Step 5: Swap staking tokens for the best APYs

Even the best crypto staking platforms offer variable APYs, meaning interest rates can change at a moment’s notice. Active buyers will often move staking funds around to ensure rewards are maximized. This is where Best Wallet’s swapping tool can be invaluable.

You can swap tokens instantly before staking them. First, click on “Trade” followed by “Swap”. Choose which staking tokens you want to swap and receive. Type in the amount and confirm – a decentralized smart contract will complete the conversion in seconds.

What is crypto staking?

Crypto staking is an innovative Web 3.0 feature that combines blockchain security with earning potential. It’s unique to networks using the proof-of-stake consensus mechanism, which is significantly faster and more energy-efficient than Bitcoin’s proof-of-work framework. It’s also fairer, with proof-of-stake networks enabling anything to earn passive rewards.

The staking process is simplified below:

- You hold staking tokens and deposit them into the respective blockchain.

- For instance, you’re holding SOL, meaning they’re sent to Solana.

- Those SOL tokens are locked into the blockchain for a minimum number of days.

- We’ll say the Solana blockchain pays an APY of 7%.

- You decide to keep the SOL tokens staked for one year, benefiting from the full 7% APY offered.

- In total, you staked 10 SOL, meaning staking rewards of 0.7 SOL (7% of 10 SOL).

- Once unstaked, you receive the original deposit and the staking rewards, totaling 10.7 SOL (10 SOL + 0.7 SOL).

The above example shows that staking is both simple and secure. It takes seconds to confirm a staking agreement and the subsequent rewards are earned passively. What’s more, tokens are staked via the blockchain, so centralized risks are avoided.

How does crypto staking work?

Let’s take a closer look at how staking works. This will ensure sufficient knowledge when selecting the best crypto staking platform.

Securing the blockchain with financial incentives

Crypto staking keeps proof-of-stake blockchains secure with financial incentives. Validators, which verify transactions and add blocks to the network, must deposit a minimum number of tokens before participating. This is their “stake” in the respective blockchain.

The idea is simple – that stake is essentially used as collateral to ensure integrity.

Should the validator attempt to cheat the network (through double spending) or become unreliable (frequent downtime), the staked tokens will be retained by the blockchain. This is known as slashing, and it’s an effective way to keep validations honest and reliable.

Validators earn rewards

Not only do honest validators keep their collateral when staking, but they also earn rewards. Those rewards are paid in the blockchain’s native token, such as SOL (Solana) or AVAX (Avalanche).

Staking rewards are generated by newly created tokens, meaning the system requires an inflationary supply. However, the staking supply is typically capped, ensuring long-term sustainability for the blockchain.

Nonetheless, you don’t need to become a validator when choosing the best crypto staking wallet. Instead, Best Wallet connects users with reputable validators via its staking aggregator. This means you can contribute small amounts without needing to actively keep the network safe.

Earning staking rewards on secondary tokens

We mentioned that staking rewards are paid in the respective blockchain’s native token. For example, staking on Ethereum pays ETH. However, BNB Chain staking yields BNB. As the best app for staking crypto, Best Wallet users can also stake thousands of secondary tokens.

This includes popular stablecoins like USDT, USDC, and DAI. Not to mention high-growth meme coins like DOGE and SHIB. These tokens aren’t staked in the traditional sense, although the process can be done securely and without centralized intermediaries.

This is because Best Wallet’s aggregator connects with hundreds of DeFi pools. Each offers a different way to earn yields, such as

Some of the most common ways to stake secondary tokens are:

- Liquidity Provision: Decentralized exchange requires liquidity to offer stable trading conditions. This is where staking can help. Best Wallet users can lend tokens to a liquidity pool, which earns them a percentage of trading fees.

- Lending Protocols: Staking rewards can also be earned when depositing tokens into a decentralized lending protocol (e.g. Aave or Compound). Borrowers pay interest on loans, which is paid to the lender.

Although centralized exchanges sometimes offer staking on secondary tokens, this option is risky. You won’t have control of the staked cryptocurrencies or the respective private keys. Performing actions, such as unstaking or withdrawals, requires approval from the exchange.

Instead, it’s best to use a self-custody wallet when staking tokens. You always retain control, ensuring third parties have no means to take your funds. As the best app to stake crypto, Best Wallet ensures self-custody ownership at all times.

Is crypto staking profitable?

Staking can be profitable. Just like depositing money into a bank account, passive interest will be earned on your crypto funds. However, there’s a lot to consider when staking, as the process isn’t guaranteed to generate financial gains. After all, you also need to consider the market value of the tokens being staked.

Let’s consider an example:

- Let’s say you’re staking NEAR tokens, which back NEAR Protocol

- You buy 1,000 NEAR at $3 each, totaling $3,000

- The staking pool pays an APY of 9%, and you stake for 12 months

- After 12 months, you’ve earned 90 NEAR in staking rewards

- Your total holdings are now 1,090 NEAR (1,000 NEAR + 90 NEAR)

However, the NEAR price is unlikely to stay the same after one year, so let’s explore profitability.

The Positive Scenario:

- Your cost basis was $3 per NEAR, and the total purchase was $3,000.

- After 12 months, NEAR has increased to $5.

- You earned 90 NEAR in staking rewards, amounting to $450 (90 NEAR x $5).

- You also have the original 1,000 NEAR, now valued at $5,000 (1,000 NEAR x $5).

- From a $3,000 purchase originally, your total NEAR holdings are worth $5,450.

The above example highlights the power of staking when the respective tokens increase.

However, the crypto markets are volatile, so let’s consider what happens when prices decline:

- After 12 months of staking, NEAR has declined to $1.50

- You earned 90 NEAR in staking rewards, amounting to $135 (90 NEAR x $1.50).

- The original 1,000 NEAR is now valued at $1,500 (1,000 NEAR x $1.50).

- The total NEAR holders are worth $1,635

As per the above, you bought $3,000 originally but the total holdings have declined to $1,635, meaning a net loss of $1,365.

Therefore, risk management should always be considered when choosing the best place to stake crypto. The best practice is to stake multiple cryptocurrencies long-term. Not only will you have a diversified portfolio but you can reduce the impact of short-term volatility.

When using Best Wallet, you can stake thousands of tokens from over 60 different networks, making diversification simple and secure.

How to choose a crypto staking platform?

Traders have many options when choosing the best crypto staking platform.

These are the most important factors to check when researching providers:

- Security and Ownership: First, it’s wise to stick with staking platforms offering strong security tools and self-custody ownership. This ensures staking practices are safe and that users retain control of their cryptocurrencies. Best Wallet never touches staked tokens nor can it access the user’s private keys. This means users can stake and unstake cryptocurrencies in a completely decentralized environment.

- Supported Staking Tokens: We mentioned the importance of diversification, so it’s important to select a staking platform that supports a wide range of tokens. The Best Wallet app supports thousands of staking cryptocurrencies across dozens of networks, including Ethereum, Solana, Avalanche, Near Protocol, and BNB Chain.

- Staking APYs: APYs are another crucial metric when choosing the best crypto staking platform. Opting for high-paying staking pools ensures rewards are maximized, allowing returns to be compounded. Best Wallet users aren’t required to shop around, as the built-in staking aggregator sources the highest crypto staking rewards in real-time.

- Validator Terms: Users should also analyze the validator’s terms when staking. This includes the staking terms, which is the number of days or months the tokens are locked. The validator’s fees and uptime should also be assessed. Best Wallet users can choose their preferred validator based on their priorities.

- Trading Tools: Staking APYs change regularly, with seasoned traders frequently swapping tokens to maximize rewards. For example, you might be earning 7% on USDT but USDC is yielding 14% in another pool. With Best Wallet, you can instantly swap tokens at competitive fees. Best Wallet also supports fiat purchases.

Best Wallet is a top option when staking cryptocurrencies via a self-custody wallet app. The in-built aggregator searches for the best crypto staking rewards so you don’t have to. Thousands of tokens can be staked in one safe place, with security tools including 2FA and biometrics.

Best Wallet offers a private staking experience without KYC checks. The Best Wallet app also supports instant token swaps and fiat purchases, ensuring unrivaled convenience. Users can also access new launchpad tokens, many of which can be staked at high APYs.

References

- What is Annual Percentage Yield (APY) and How Does it Work? (HFS Federal Credit Union)

- What Is Crypto Staking and Why Is the SEC Cracking Down? (Bloomberg)

- Proof of Stake Crypto-Economy Basics (Bloomberg)

- Validators Form the Backbone of Solana’s Network (Solana)

Frequently asked questions

Crypto staking is safe when using the Best Wallet app, with users benefiting from self-custody storage alongside biometrics and 2FA. However, users should consider the risks of staking, as losses are possible if the tokens decline in value.

In general, it makes sense to stake cryptocurrencies rather than keep them idle in the Best Wallet app. However, users should assess staking terms, including the lock-up period and validator fees.

Some of the best crypto coins to stake include ETH (Ethereum), SOL (Solana), NEAR (Near Protocol), and ADA (Cardano). You might also consider staking launchpad tokens like HYPER (Bitcoin Hyper), WEPE (Wall Street Pepe), and MAXI (Maxi Doge) for much higher APYs.

Yes, most countries tax crypto staking rewards as income based on the value of the tokens when they’re received.