Best Altcoins to Buy Now in 2025

The Best Wallet app supports millions of altcoins from over 60 blockchain ecosystems. Users can buy, sell, and trade established altcoins from high-growth narratives like meme coins, AI, DeFi, and RWA. The built-in Launchpad also offers access to new altcoins before they launch on exchanges, providing users with a first-mover advantage.

Read on to discover the best altcoins to buy that could be set for explosive gains. Learn which Web3 categories whales invest money in and which altcoin narratives could trend in 2025.

9 best altcoins to buy right now

- Bitcoin Hyper (HYPER) – Brings DeFi and instant transactions to Bitcoin with Layer-2

- Maxi Doge (MAXI) – Doge-themed meme coin that personifies today’s degen trader

- PEPENODE (PEPENODE) – Mine meme coins at home without the expense

- Snorter Token (SNORT) – Snipe meme coins like a pro in a Telegram interface

- Best Wallet Token (BEST) – Blockchain-powered utility token that unlocks multiple perks for Best Wallet users

- SUBDD (SUBDD) – AI-powered content subscription platform connecting influencers and fans

- Little Pepe (LILPEPE) – Ethereum-based L2 brings down crypto taxes

- SpacePay (SPY) – Crypto right at the Point of Sales machine

- Ethereum (ETH) – De facto smart contract blockchain with thousands of popular dApps

Exploring the best altcoins to invest in

The altcoin market offers higher upside potential than Bitcoin, yet picking suitable investments remains challenging. Millions of tokens circulate in the broader ecosystem from a wide range of Web 3 categories.

Let’s explore the best altcoins with the most potential. Each altcoin is available on the Best Wallet Launchpad or exchange, depending on whether the token is in presale or live.

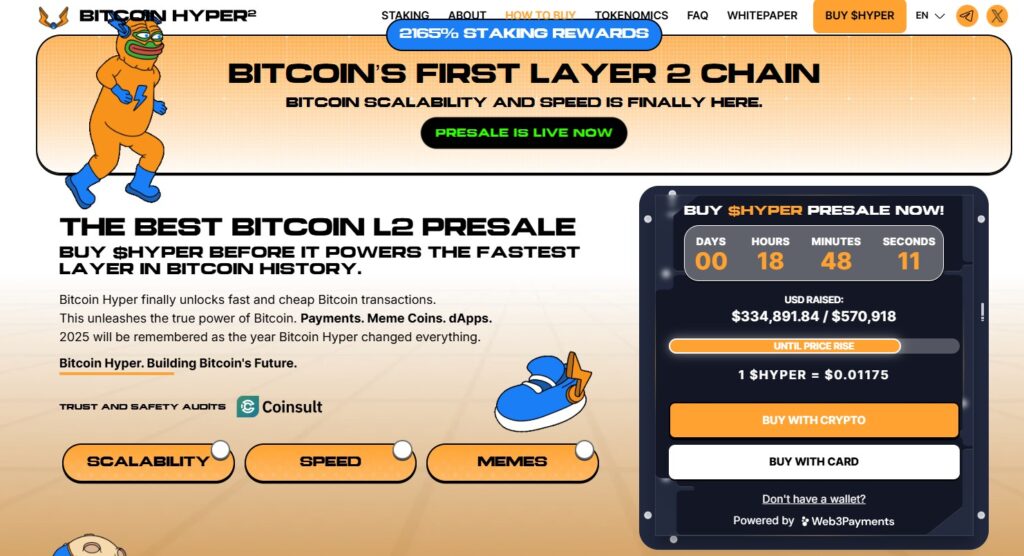

1. Bitcoin Hyper (HYPER): Brings DeFi and instant transactions to Bitcoin with Layer 2

Bitcoin’s great for holding and using as ‘digital gold,’ but it is not optimized for other crypto purposes. Bitcoin Hyper flips the script by launching a lightning-fast Layer 2 network on the Solana Virtual Machine, designed to make Bitcoin more usable, more scalable, and a whole lot more fun.

With Bitcoin Hyper, your BTC is bridged to a high-speed Layer 2 and converted 1:1 into $HYPER, a token that uses Solana to enable low-fee transactions, staking, lending, and decentralized applications. The bridge is secure, non-custodial, and easy to use, making it beginner-friendly without sacrificing trust.

Unlike many presales that require waiting for rewards, $HYPER can be staked immediately, offering APYs of around 80% to early adopters. Hyper real tokenomics, audited contracts, and a roadmap that includes major exchange listings and DAO governance by 2026.

Investors have already shown their confidence, allotting $18 million to the project so far.

Whether you’re a BTC maxi curious about DeFi or just looking for a Layer 2 with upside, Bitcoin Hyper could be a smart move. Fast transactions, real yield, and the chance to put your Bitcoin to work? It’s not bad for a coin that often just sits still.

2. Maxi Doge (MAXI): Popular altcoin that brings a fresh take on doge-themed meme coins

With five out of the top ten meme coins by market cap being taken by dog coins, there’s no doubt that the doge meta is still strong. But unlike Dogecoin, Shiba Inu, Bonk, Dogwifhat, and Floki, which are known for their cute and fun mascots, Maxi Doge appears on the scene, trading with 1000x leverage and lifting 10-ton candles.

This fresh new take on the dog meme could succeed because it still uses a doge character, while it deviates from all the Dogecoin derivatives in its appearance to make it unique. It also offers utility through staking rewards with a dynamic yield of around 130% during its presale, as well as various competitions and tournaments designed to reward and engage its community members.

The team behind MAXI is working diligently to ensure its success. They’ve already allocated 25% of the total token supply for future partnerships and events, positioning the token for a potential listing on a futures exchange. This could be massive for the token, as it would allow degens to trade MAXI with 100x or 1000x leverage.

While the Maxi Doge is slowly gaining traction, some experts believe that Shiba Inu and Dogecoin investors are rotating their profits. The recent outflows from these two coins, combined with the MAXI presale raising over $100,000 within minutes (and currently exceeding $2.5 million), suggest that this rotation may be underway.

3. PEPENODE (PEPENODE): Mine meme coins at home without the expense

PEPENODE turns mining into a strategy game. You build a digital server room, stock it with node types purchased in PEPENODE, and explore combinations that can increase your mining power. You can upgrade your facility to expand production and collect rewards in both PEPENODE and partner meme coins, such as PEPE and Fartcoin.

The coin’s tokenomics encourages long-term participation. There are more than 210 billion tokens minted. The presale opened at $0.001 and is already climbing in managed increments.

PEPENODE also encourages scarcity, with 70% of tokens used on upgrades “bought back and burned”, and 2% of mining rewards being shared with referrers. Staking is available with boosted early returns.

You can already start mining in the off-chain version, with the full on-chain rollout slated to be operational after the Token Generation Event. The team has scheduled exchange listings for Q3 to Q4 2025.

That’s not all. There’s a public leaderboard that tracks performance, stronger nodes for those who join early, and additional payouts for top miners in established meme coins like PEPE or Fartcoin, including a twenty percent uplift on PEPE rewards.

PEPENODE is an ERC-20 token based on Ethereum. It is available on Best Wallet, compatible with MetaMask and WalletConnect, and accepts ETH, BNB, USDT, and even credit cards.

4. Snorter Token (SNORT): Snipe meme coins like a pro in a Telegram interface

One of the most intriguing meme coins of 2025 is Snorter Token, a Solana-based meme coin that doubles as a sniper bot operating on Telegram, allowing users to buy, snipe, and manage tokens instantly from within the chat.

While coins like PEPE and BONK rely on virality, Snorter builds real tools, with the sniper bot being the attention-grabbing feature, allowing users to snipe meme tokens as they launch.

Other features for SNORT holders include sub-second execution, MEV protection, copy-trading, and honeypot detection. It is also one of the few meme coins offering multi-chain support and bridging, staking rewards, and fee reductions for active traders.

This is a brand-new project, offering presale investors the opportunity to start early during the pre-programmed price rises. Once the presale is complete, the wider market can access Snorter Token through exchange listings.

5. Best Wallet Token (BEST): Wallet ecosystem token that unlocks lower fees, higher APYs, and governance rights

BEST tokens power the Best Wallet app, unlocking a range of benefits for wallet users. Token holders receive priority access to new Launchpad events, gaining a first-mover advantage, lower token price, and the ability to invest before the public sale.

The tokens also provide lower transaction fees on multiple Best Wallet products and higher APYs when using the built-in staking aggregator.

BEST also provides governance rights within the Best Wallet ecosystem, so holders can vote on new features and material operating decisions. The team will develop additional use cases as the BEST community grows, ensuring long-term holders are rewarded for their loyalty.

The BEST token sale is available on the Best Wallet Launchpad — no minimums apply, and participants can use ETH, USDT, or BNB. The campaign has already raised over $16 million.

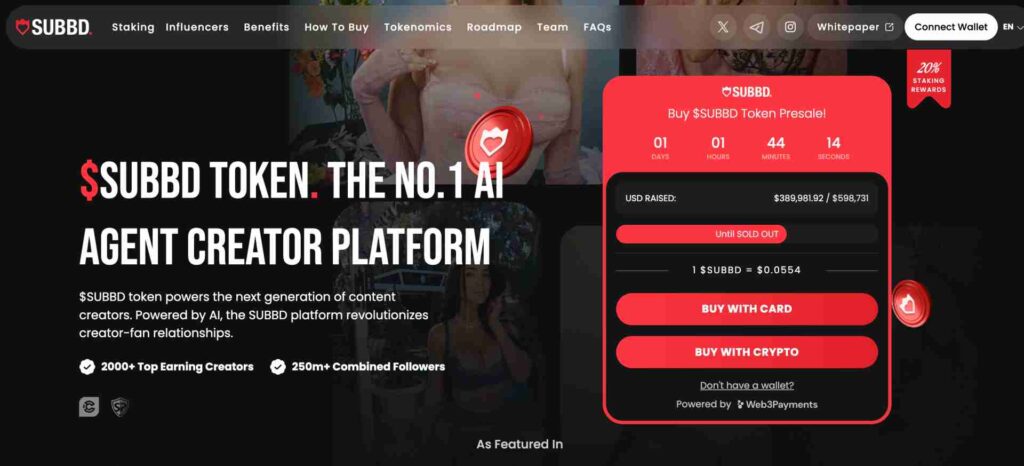

6. SUBBD (SUBBD): Blockchain-based content creator platform with 250 million combined followers

SUBBD is a content creation platform that connects influencers and fans via the Ethereum blockchain. It leverages AI to streamline creator tasks, including automated streams, videos, and voice notes.

SUBBD is the ecosystem token — it streamlines creator earnings and provides fans with reduced subscription fees. Fans are also encouraged to stake SUBBD, as they receive 20% APY and unlock exclusive features with their favorite creators. Perks include behind-the-scenes footage, bespoke content requests, and early drops. SUBBD holders can also create AI-powered influencers and monetize them through monthly subscriptions.

The SUBBD brand is already established, with the platform attracting over 2,000 top creators with a 250 million combined audience. The next milestone to reach is 1 billion followers — the team has allocated 30% of the token supply to position SUBBD as the global leader in content subscription services.

The fundraising event recently went live on the Best Wallet Launchpad, allowing users to purchase SUBBD tokens at a discounted rate. The Launchpad price rises every few days to reward early participation, and it accepts ETH, USDT, and BNB as payment currency.

7. Little Pepe (LILPEPE): New L2 solves two of crypto’s most annoying problems

Little Pepe (LILPEPE) disguises itself as a meme coin (always a good way to get attention), and then smuggles utility directly into the market.

The EVM-compatible Layer 2 chain addresses two problems that plague the cryptocurrency world: crypto taxes and sniping bots.

The incoming L2 will offer 0% tax on buys and sells (which stacks up to a big saving for regular traders).

With taxes out of the way, Little Pepe turns its attention to sniper bots: those pesky automated traders that aim to swoop in on new coins and ride early pumps before dumping their tokens.

That not only hurts regular, careful traders, but also projects themselves, seeking a fair valuation without the noise created by bots.

So with two novel skills under its bet, it’s no surprise that the presale for the governing token LILPEPE has already soared over $25 million before even reaching a single exchange.

Wrapped up in a frog coin narrative, and with massive holder contests (like a current $777,000 giveaway which will be divided across 10 presale participants), LILPEPE has all the makings of a large success.

8. SpacePay (SPY): Crypto right at the Point of Sales machine

SpacePay might be the final mile, helping make crypto mainstream. After all, it’s no good if your mum and dad can’t use it.

With support for over 300 wallets and no need for a tech refresh beyond installing an app on common Android-based payment systems at tills, SpacePay enables any shop to add crypto as a payment option.

The work of the UK firm translates globally, with almost any shop able to support the most popular cryptocurrencies. Customers with crypto on their phone can pay instantly via NFC. It’s no wonder the early presale has quickly surpassed $1.2 million.

There’s a neat nuance to how SpacePay operates: payments are then converted to local fiat after the purchase, meaning shopkeepers do not need to scratch their heads figuring out how a coin is performing (which would play havoc on balance sheets). Instead, the merchant gets stable dollars while customers get an easy payment method.

The presale is now active, and holders of the SPY token will receive a share of revenue from SpacePay’s 0.5% transaction fees, as well as a vote in the future direction of the project. Exclusive features for holders are also promised by the team over time.

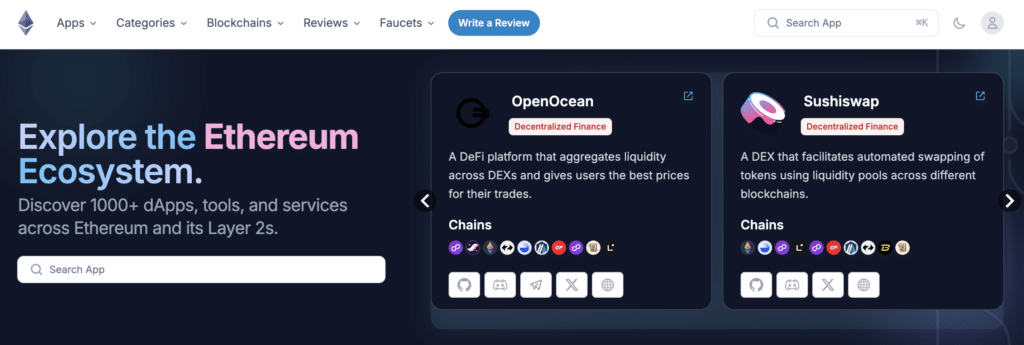

9. Ethereum (ETH): The leading ecosystem for DeFi, NFTs, metaverses, games, and other Web 3.0 applications

Ethereum is the original smart contract platform and remains the most active blockchain for decentralized applications (dApps). Thousands of innovative projects use the Ethereum ecosystem — from decentralized exchanges (DEXs), stablecoins, and metaverses to play-to-earn games and cryptocurrency loan platforms. While secondary projects have native tokens, network fees must be paid in ETH, ensuring long-term demand as the ecosystem grows.

The Ethereum blockchain operates on the proof-of-stake mechanism, but unlike key competitors, scalability remains a major issue. The ecosystem is capped at about 15 transactions per second, increasing reliance on layer-2 solutions like Polygon and Base. The core team is developing several upgrades to address these issues — the most recent, “Pectra”, improves efficiency and user-friendliness.

The Pectra upgrade was well-received by the cryptocurrency markets, with the ETH price rising by 45% in just seven days since it went live. Even so, blockchain analysts argue that ETH is massively undervalued, with 2025 altcoin price predictions averaging $5,000 to $10,000. The long-term horizon is where the true value lies — ARK Invest forecasts a $20 trillion market capitalization by 2032, valuing ETH at approximately $180,000.

What is an altcoin?

Altcoins are “alternative coins” that refer to all cryptocurrencies other than Bitcoin.

The first altcoin, Namecoin, launched in 2011 as a Bitcoin fork — millions of others have followed, creating an abundance of investment opportunities for cryptocurrency investors.

A small percentage of altcoins operate on their own blockchain — these are “coins” and examples include Ethereum, BNB, Avalanche, and Solana. The majority of altcoins run on these blockchains, and they’re called “tokens.” For example, Ethereum-based altcoins like Uniswap and Aave are ERC-20 tokens, while those on BNB use the BEP-20 standard.

Why buy altcoins instead of Bitcoin?

With millions of options to choose from, altcoins provide broad exposure to digital assets across a range of use cases and narratives. One example is smart contract platforms like Ethereum and Solana, which support entire ecosystems. Secondary projects pay network fees in the platform’s native altcoin, driving long-term demand.

Utility-driven altcoins are also popular, as they unlock specific functions within an ecosystem. LINK, for instance, is used to obtain real-time data from Chainlink Oracles, while XRP provides financial institutions with a liquidity bridge when they make cross-currency transfers. Other leading altcoin niches include meme coins, metaverses, gamification, and DeFi. This diverse range of markets allows altcoin investors to build diversified portfolios, rather than focusing exclusively on Bitcoin.

Altcoins also offer higher upside potential than the world’s largest cryptocurrency, as Bitcoin typically represents 50-60% of the entire market’s value. Investors can choose the best altcoins to buy based on their risk tolerance and goals — market capitalizations range from under $1 million to over $200 billion.

Altcoin portfolios are also better suited to investors who seek exposure to technical innovation. Bitcoin is the sector’s “digital gold” and store of value, while altcoin projects develop real use cases and solutions to existing problems. The DeFi ecosystem is a good example — consumers can trade, earn yields, and borrow funds without relying on centralized platforms, making conventional financial services accessible globally.

Altcoins are also more efficient than Bitcoin. The blockchain handles just 7 transactions per second, requires 10 minutes for settlement, and consumes more energy than entire countries. Next-gen altcoins like Solana and Sui offer sub-second transactions that scale into the thousands per second.

Different types of altcoins

Seasoned cryptocurrency investors build diversified portfolios that cover various altcoin markets. This risk-averse approach reduces exposure to any single investing category and ensures access to multiple high-growth narratives.

The following sections reveal the core cryptocurrency types to explore when choosing what altcoins to buy.

Smart contract platforms

Smart contract platforms are the backbone of the altcoin sector. Smart contracts support trustless agreements in a transparent and decentralized environment. They allow two or more parties to enter into a virtual agreement, and their immutability ensures that terms can’t be amended. Smart contracts execute automatically when those terms are triggered, whether that’s an insurance premium or a decentralized token swap.

Smart contract platforms are native blockchains that enable developers to build secondary projects, providing core infrastructure for millions of cryptocurrencies. These projects are called dApps — online interfaces that run on smart contracts, removing centralized parties from the transaction process.

The leading smart contract by dApp activity is Ethereum. It supports games, metaverses, exchanges, stablecoins, lending protocols, and more. All dApp transactions use ETH to cover network fees (known as “gas”) — this financial model generates billions of dollars in annual revenue for the blockchain.

Ethereum’s mega-cap valuation might not suit all investor profiles, especially those who seek higher upside. BNB and Solana hold about a third of Ethereum’s market capitalization, while Tron, Sui, Cardano, and Avalanche trade at even smaller valuations.

Layer-2 networks

Layer-2 networks, which also facilitate smart contracts and dApps, enhance existing layer-1 blockchains, often to improve efficiency. Polygon, Base, and Optimism provide Ethereum-based ecosystems with higher scalability and lower fees. Meanwhile, Bitcoin Hyper brings Solana’s advantages to Bitcoin.

Layer-2 projects also provide increased functionality to existing blockchains that may lack certain features. Stacks and Merlin Chain bring DeFi capabilities to Bitcoin, allowing BTC holders to access yields and secured loans. These use cases are significant, as the Bitcoin blockchain lacks support for smart contracts.

DeFi coins

According to blockchain experts, the best altcoins to watch operate in the DeFi sector. Market estimates vary, although Bloomberg reports that DeFi will generate trillions of dollars by the end of the decade. DeFi’s key objective is to decentralize traditional financial services, improving access and affordability, particularly in the developing world.

Investors can diversify into multiple DeFi categories, including the following:

- Trading: DEXs like Uniswap, SushiSwap, Raydium, and PancakeSwap handle billions of dollars in daily trading volume. They enable traders to buy and sell tokens via liquidity pools — no accounts or KYC requirements apply.

- Yields: DeFi platforms let investors earn yields on their cryptocurrencies without relying on centralized products like savings accounts and bonds. Various DeFi mechanisms support competitive APYs, including staking, liquidity provision, and yield farming.

- Loans: Innovative ecosystems like Aave and Compound offer cryptocurrency loans without credit checks or long application processes. Users deposit collateral and borrow established digital assets like USDT and ETH — borrowers pay competitive interest rates until the loan is repaid.

- Derivatives: DeFi solutions also extend to derivative products. They let investors trade assets with leverage, and popular instruments include perpetual futures and options. Similar to DEX trading, cryptocurrency derivatives remove third parties from the equation.

- Liquid Staking: An extension of DeFi yields, liquid staking platforms offer instant liquidity when users deposit cryptocurrencies into staking pools. One example is Lido, which offers stETH on a 1:1 ratio when you stake ETH. Those stETH tokens can be used for other DeFi initiatives like lending and trading, while the original ETH earns yields.

Meme coins

Meme coins are the most popular altcoins among retail clients. Most meme coins lack use cases or utility and are often created to honor popular culture, internet memes, or public figures.

Launched in 2013, the original meme coin is Dogecoin (DOGE), and it’s based on a Shiba Inu dog. The Dogecoin community has millions of holders, including Tesla CEO Elon Musk, who endorsed the meme coin several times during its 2020/21 rally. Many other meme coins have achieved billion-dollar market capitalizations, including Shiba Inu (SHIB), Pepe (PEPE), Bonk (BONK), and dogwifhat (WIF).

Even President Trump launched his own meme coin in January 2025. OFFICIAL TRUMP (TRUMP) runs on the Solana blockchain, and it reached a $15 billion market capitalization at its peak.

Meme coins can produce explosive growth when they achieve virality, often yielding gains of thousands of percent over a short time frame. A recent example is Fartcoin (FARTCOIN), which launched in November 2024 at $0.000004723 and climbed to $2.61 just three months later — this parabolic trajectory reflects gains of over 55 million percent.

Experts explain that meme coins are highly speculative and that the market often responds to narratives. For example, meme coins from specific ecosystems collectively rally, whether that’s Solana, Base, or Ethereum. Meme coin narratives also follow certain project categories, such as dogs, cats, or Trump-related tokens.

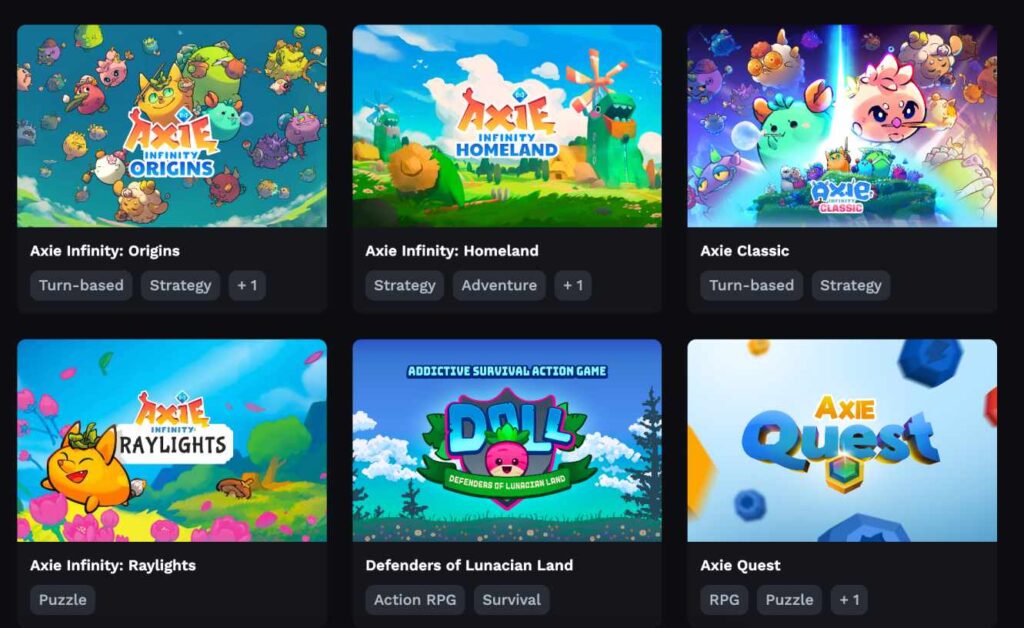

Gaming coins

The blockchain sector is home to a range of gaming projects. One of the fastest-growing markets is play-to-earn (P2E) games — they allow players to earn cryptocurrencies, converting time into real-world rewards.

Top gaming projects also incorporate non-fungible tokens (NFTs) into their ecosystems. Axie Infinity is one example — players mint virtual creatures called “Axies”, which are backed by unique NFTs. The value of each Axie reflects its rarity, and players can trade them on NFT marketplaces. Axie Infinity witnessed substantial adoption during the 2021 bull cycle, with over 2.7 million monthly active users.

Telegram games are another segment of the blockchain gaming category. Players access these games within the Telegram app, now home to over 1 billion users. Hamster Kombat is the most successful Telegram game to date, boasting over 300 million active players at its peak. Players act as CEOs of a cryptocurrency exchange and earn points when they complete milestones, such as achieving tier-one status. Hamster Kombat converted those points to HMSTR tokens in September 2024 via an airdrop campaign.

You may also consider metaverse projects when exploring the best altcoins to invest in. The Sandbox (SAND) and Decentraland (MANA) are the most widely recognized metaverses — each enables users to buy virtual land plots that are tradable as NFTs. During the metaverse hype in 2021, several high-profile purchases saw land plots sell for several million dollars.

AI coins

The AI narrative has found its way to cryptocurrencies, driving one of the fastest-growing altcoin markets. Similar to DeFi, AI cryptocurrencies operate in several sub-niches, making it seamless to build a diversified portfolio.

AI infrastructure projects command the largest market capitalizations — they provide critical services like decentralized computing power, AI data training, and incentivization networks to run machine learning models.

Stablecoins

Stablecoins represent traditional money but on the blockchain. They’re designed to maintain their value with the US dollar and other fiat currencies, often through audited reserves or algorithmic controls.

USDT is considered the de facto stablecoin. It’s the largest by market capitalization and frequently generates over $100 billion in daily trading volume. Other leading stablecoins include USDC, Dai (DAI), and Ethena USDe (USDe).

Note that cryptocurrency investors don’t buy stablecoins for price appreciation, as their value is pegged to the underlying currency. Stablecoins serve other use cases, such as exchange liquidity, cost-effective payments, DeFi yields, and hedging. Experts recommend allocating a small portion of portfolios to stablecoins to capitalize on market dips.

How to find the best altcoins to buy

Experienced investors rely on these metrics when deciding which altcoins to buy:

- Market Capitalization: The risk and reward are directly influenced by the altcoin’s market capitalization. Large-cap projects like Ethereum and BNB have a lower upside, but they’re also less volatile. Those exploring the next 1000x tokens may target cheap altcoins with small-cap valuations — often new startups with unproven concepts.

- Altcoin Narrative: Seasoned investors often buy altcoins from trending or high-growth narratives, allowing them to experience the full growth cycle. Examples include DeFi, meme coins, and AI.

- Trading Volume: Look for altcoins with a high volume-to-market-capitalization ratio, especially if you’re a short-term trader. This powerful indicator often suggests the token is about to blow up, as extremely high volumes suggest widespread interest.

- Use Cases: Evaluate the altcoin’s use case within its ecosystem — utility-driven cryptocurrencies unlock special features or perks, which often drive long-term demand.

- New Exchange Listings: Altcoins often surge after listings on major exchanges like Binance and Coinbase, so following the top platforms on social media is a smart move. You can also sign up for an exchange alert to secure a first-mover advantage.

- Adoption Trends: The leading altcoin projects enjoy growing adoption, meaning real users and transaction activity.

- On-Chain Data: Altcoin investors analyze on-chain data to identify new trends before they become mainstream. Key metrics include unique holders, token distribution, and TVLs.

Risks of trading altcoins

A variety of risks must be considered before investing in altcoins.

Altcoins have smaller market capitalizations than Bitcoin, leading to higher volatility and wilder pricing swings. Volatility intensifies when investing in small-cap altcoins, similar to trading penny or growth stocks. Small-cap markets have limited liquidity, too, so exiting a trade often means accepting a less favorable price. Those with a low risk tolerance prefer established altcoins with large valuations, such as Ethereum, Solana, and BNB.

Operational risks are another consideration. Investing in altcoins with innovative use cases can yield substantial gains if the project succeeds, but many fail to deliver on their roadmap targets. Rising competition in key altcoin sectors has led to market saturation, making it harder to retain investor interest. The best practice to mitigate operational risks is diversification — spread funds across multiple altcoins from each niche rather than overexposing to any single project.

The most critical altcoin risk is investing in a scam project. Anonymous founders are often behind new token launches, allowing scammers to avoid scrutiny if things go wrong — from sudden rug pulls, honeypots, or dumping team-held tokens. Extensive research and due diligence are crucial to mitigate these risks.

What is altcoin season?

Altcoin season is a highly anticipated event for many cryptocurrency investors. It refers to an extended period, often lasting for several months, where the majority of altcoins post explosive gains.

Altcoin season historically forms part of a broader four-year market cycle that begins with the Bitcoin halving event. This event typically triggers a prolonged Bitcoin rally, with BTC reaching multiple new all-time highs.

In the second stage, Ethereum begins to consistently outperform Bitcoin, followed by strong performances from the top altcoins to invest in, like BNB, Cardano (ADA), and XRP (XRP).

The final phase sees capital rotate into riskier low-cap altcoins. Projects tied to trending narratives often produce the highest returns — DeFi, metaverses, and play-to-earn games led during the previous altcoin season.

Altcoin season ends when the wider markets peak — Bitcoin dominance begins to rise, followed by a significant correction and bearish price trends that persist until the next cycle starts.

Altcoin market trends

Meme coins are producing sizable gains, with large-caps like dogwifhat, Pepe, and Floki attracting significant buying pressure.

The Base ecosystem is also gaining momentum again. The layer-2 network is backed by Coinbase — the exchange has listed multiple Base projects, including meme coins like Doginme (DOGINME), Toshi (TOSHI), and Degen (DEGEN). More Coinbase listings are expected in the months to follow.

In terms of future trends, altcoin season generally favors utility-driven altcoins from key blockchain narratives. Analysts suggest that DeFi, AI, and real-world assets (RWA) will lead the way, so gaining exposure to these altcoin categories while prices remain low may be a sensible strategy.

Conclusion

Best Wallet users have access to millions of top altcoins from Ethereum, BNB Chain, Polygon, and other leading blockchains. Users can purchase altcoins with credit cards and other traditional payment methods, or swap them via the Best Wallet DEX.

The Best Wallet Launchpad is also popular with altcoin investors — it lets users invest in pre-vetted startups before they launch on exchanges. Bitcoin Hyper is a fantastic example of that, bringing fast transactions to BTC thanks to the speed of Solana.

Buy Bitcoin Hyper on Best WalletReferences

- Cathie Wood’s bullish Ethereum (ETH) prediction: How much $1,000 and $10,000 invested could be worth (AOL)

- Decentralized finance market size, share & trends analysis report (Grand View Research)

- DeFi fans are courting traders in $7.2 trillion currency market (Bloomberg)

- Exclusive: Trump’s meme coin made nearly $100 million in trading fees, as small traders lost money (Reuters)

- How Telegram game Hamster Kombat got 300 million users—and the ire of Iran’s military (WIRED)

- The AI trade has blown up in crypto (Bloomberg)